加拿大华人论坛 加拿大房产请大家帮忙,关于卖房交税问题

在加拿大

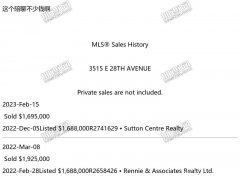

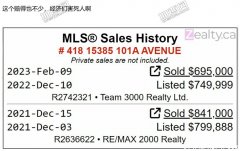

第一套房子(condo)今年8月份交的房,至今没出租过,第二套(condo)房十月底也要交房了。问题是如果现在把第一套房子卖掉的话,注意卖掉是在十月底之后也就是在第二套房子交接之后,增值的部分要交税吗?如何交? 问题二,如果不卖第一套,用来出租,以后增值的部分怎么交税? 请大家帮忙了,很急啊,第二套房要交房了。

评论

回复: 请大家帮忙,关于卖房交税问题第一套房子(condo)今年8月份交的房,至今没出租过,第二套(condo)房十月底也要交房了。问题是如果现在把第一套房子卖掉的话,注意卖掉是在十月底之后也就是在第二套房子交接之后,增值的部分要交税吗?如何交? 问题二,如果不卖第一套,用来出租,以后增值的部分怎么交税? 请大家帮忙了,很急啊,第二套房要交房了。点击展开...LZ, 把你第一套 CONDO做主住房, 卖掉就不交增值税, 第二个用去出租为投资房, 提醒你, 第一个不要急着卖, 才几个月就卖是赚不了钱的, 很可能扣除佣金后会亏, 如果你把第二个做主住房, 第一个去出租几年升值后卖掉要交税, 拿卖价减买时的价的差, 乘50%, 合在你的家庭年收入一起报税, 比如, 升值10万, 最多交给政府是23%, 你能赚7万7.

评论

一旦你拥有房产, 你就拥有了家园,土地,财富和主权.[SIGPIC][/SIGPIC]LZ, 把你第一套 CONDO做主住房, 卖掉就不交增值税, 第二个用去出租为投资房, 提醒你, 第一个不要急着卖, 才几个月就卖是赚不了钱的, 很可能扣除佣金后会亏, 如果你把第二个做主住房, 第一个去出租几年升值后卖掉要交税, 拿卖价减买时的价的差, 乘50%, 合在你的家庭年收入一起报税, 比如, 升值10万, 最多交给政府是23%, 你能赚7万7.点击展开...不准确:1)第一个即使卖了,也算是PRINCIAL RESIDENCE。不缴CAPITAL GAIN税。2)如果1年之后卖,有分摊的CAPITAL GAIN,详见公式。1) YOUR HOME AND TAXES! WHY IS IT IMPORTANT TO YOU? Profit on the sale of real estate is generally subject to tax. However, a capital gain (profit) on the sale of your PRINCIPAL residence can be exempt from taxation in Canada. 2) WHAT TYPES OF PROPERTY ARE INCLUDED UNDER THE DEFINITION OF PRINCIPAL RESIDENCE? A house.An apartment or unit in a duplex, apartment building or condominium.A cottage.A mobile home.A trailer, orA houseboat.A leasehold interest in any of the above.A share of the capital stock of a co-operative housing corporation, if such share is acquired for the purpose of obtaining the right to inhabit a housing unit owned by that corporation. Per Canada Revenue Agency IT-120R6 3) UNDER WHAT CIRCUMSTANCES IS 100% OF THE CAPITAL GAIN ON THE SALE OF YOUR PRINCIPAL RESIDENCE EXEMPT? You or a personal trust (but not a corporation) owned the property solely or jointly.You were a resident of Canada throughout your ownership of the housing unit.The principal residence was ordinarily inhabited by you, your spouse, common law partner, (current or former) or your child. (adult or underage). The exception is an election under Subsection 45(2) or 45(3) of the Income Tax Act, which allows you a four-year exemption from ordinarily residing in it. The exemption can be more than four years if your job requires you to stay elsewhere. See 13 below. You, your spouse or your children under the age of eighteen DO NOT own another property, which they designated as their principal residence.The primary purpose for acquiring and selling your principal residence was NOT to make a profit.The property’s use was NOT totally or partially changed throughout your ownership. (Post 1971) Partial conversion gives partial exemption see below.The land on which the principal residence was built does NOT exceed half a hectare (5,000 square meters or 1.23 acres). This limitation could be increased depending on zoning by-laws and proof that a larger acreage was necessary for the full enjoyment of the property. You did not own the land on which you built your principal residence for more than two years before putting a building on it and ordinarily inhabiting it. 4) HOW IS THE CAPITAL GAINS EXEMPTION CALCULATED? The exemption equals 100% of the gain if you could and did designate your home, as your principal residence for every year that you owned it. The exemption is reduced proportionally for every year that the property was owned but not designated as your principal residence. The formula is: Exemption = Gain * (Years Designated +1)/ Years Owned. The number of years is calculated from 1971 onwards. TIP The + 1 in the formula above means that you can designate your home for all the years you ordinarily inhabit it plus an extra year. If you have two homes that could qualify as a principal residence you should try and take the best advantage of this one extra year by using it to designate the home that gives you the largest capital gains exemption. TIP Keep all receipts of improvements to your principal residence so as to reduce any possible capital gain on its sale. 5) WHAT IS MEANT BY DESIGNATING A HOUSING UNIT AS YOUR PRINCIPAL RESIDENCE AND HOW IS THIS DONE? When a housing unit fits the definition of your principal residence (see 3 above) you can at the time you sell it or it is deemed to have been disposed of designate it as your principal residence for each of the years, which you owned it. The designation should be made for each of the years the property was owned using form T2091. The form need not be filed with the tax return for that year unless a taxable capital gain remains after using the exemption or if a form T664, Election to Report a Capital Gain on Property Owned at the End of February,22 1994 was filed.

评论

回复: 请大家帮忙,关于卖房交税问题楼上写的好复杂啊 ,能简单点吗 ,最好中文 。如果我 同时拥有两个物业,但都没出租,把其中一个卖了 ,卖的这个所赚的钱要交税吗 ?

评论

回复: 请大家帮忙,关于卖房交税问题翻成中文就是:如果今年或明年卖,不用交税。

评论

回复: 请大家帮忙,关于卖房交税问题谢谢楼上耐心回答,看来把一个出租然后再卖的话 ,还不如现在就卖了啊 ,税挺高啊

·加拿大新闻 61.5万元起售,提供两个配置级,潜在用户该怎么选这车?

·加拿大新闻 第六代丰田RAV4,还是美版好!

·加拿大新闻 NBA通知所有球队:开始进行审查识别可疑投注行为

·加拿大新闻 月销又过万,这车总能卖得好,多款车型在售,家用如何选

·加拿大新闻 独一份!兰博基尼入华20周年纪念款亮相,收藏党冲!

·汽车 “抓斗”雨刷片

·汽车 2018款沃尔沃V60