在加拿大

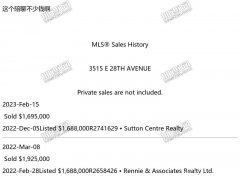

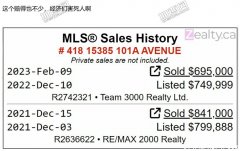

想问一下各位有没有经验是把房子从一方转到另外一方,但是按照市价转移,就是不申请subsection 73(1)?目的是以后的房租收入和capital gain让tax bracket低的人来申报。

评论

都已经是夫妻 还折腾干啥

评论

原帖由 小火鸡 于 2021/5/25 21:53:15 发表

都已经是夫妻 还折腾干啥

合理避税啊,房租收入现在都是在我名下,政府要拿走一半

评论

http://www.canada.ca/en/revenue ... on-law-partner.html

http://taxpage.com/articles-and-tips/transfer-of-property-between-spouses-attribution-rules/#:~:text=Under%20section%2074.2%20of%20the,is%20on%20title%20for%20it.

Attribution of Income following Transfer of Property between Spouses

Under section 74.2 of the Income Tax Act, any income that is generated following the transfer of property from one spouse to another is attributed back to the person who transferred the property. The income is not deemed to be earned by the person who “owns” the property or is on title for it.

For example, a wife may transfer her dividend yielding portfolio to her husband so that he is listed as the legal owner of the equities therein. There are no immediate tax consequences to this transfer. However, reporting obligations are triggered when the portfolio generates income. Even though the husband has legal title to the portfolio, any income generated is attributed to the wife. She has to report this income when she files her taxes. Not the husband.

评论

即使房子鞋其中一个人的名字,只要你俩是夫妻关系,该交的税都要交,除非你俩假离婚,一人一套房,原本的投资房就变成自租房,卖房时不用交capital gain。

评论

原帖由 ENCORES 于 2021/5/25 22:19:26 发表

即使房子鞋其中一个人的名字,只要你俩是夫妻关系,该交的税都要交,除非你俩假离婚,一人一套房,原本的投资房就变成自租房,卖房时不用交capital gain。...... 那是肯定要交的,但夫妻的tax bracket不一样,区别可以很大。

评论

原帖由 fuu 于 2021/5/25 22:11:06 发表

http://www.canada.ca/en/revenue ... on-law-partner.htmlhttp://taxpage.com/arti......

If you sold the property to your spouse or common-law partner or a trust for your spouse or common-law partner and you were paid an amount equal to the fair market value (FMV) of the property, there is another way to report the sale. Generally, you can list the sale at the property's FMV, and report any capital gain or loss for the year you sold the property. To do this, you have to file an election with your return. To make this election, attach to your return a letter signed by you and your spouse or common-law partner. State that you are reporting the property as being sold to your spouse or common-law partner at its FMV and that you do not want subsection 73(1) of the Income Tax Act to apply.

If your spouse or common-law partner or the trust later sells the property, your spouse or common-law partner or the trust has to report any capital gain or loss from the sale.

我想问的是这个,http://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-income/line-127-capital-gains/transfers-capital-property/transfers-property-a-spouse-common-law-partner-a-trust-a-spouse-common-law-partner.html

评论

转移如果有贷款的话 得银行同意 (我记得)

·加拿大新闻 国际学生名额锐减安省学院陷入财政困境

·加拿大新闻 高速公路惊现“无人驾驶”特斯拉网友直呼太惊险

·加拿大新闻 [重磅] 加拿大唯一华人大型连锁健身器材温哥华盛大开业!

·加拿大新闻 奔驰主力车型全面升级,以对中国深层理解满足每一个期待

·加拿大新闻 加拿大房市踩刹车11月成交量大跌一成

·生活百科 黑色星期五购物郁闷

·澳洲新闻 年中预算更新显示财政底线改善 84 亿美元