加拿大华人论坛 加拿大房产[评论]在温养房耗每月9成收入 房贷经纪∶房价不会大跌

在加拿大

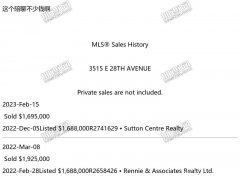

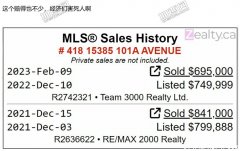

新闻:《在温养房耗每月9成收入 房贷经纪∶房价不会大跌》的相关评论在温养房 耗每月9成收入 全国住房负担恶化,在温哥华拥有一栋独立平房需花去家庭税前收入的91%。图为一名地产经纪人所代理的物业成交。(加通社) 加拿大皇家银行(RBC)27日发表最新报点击展开...100%的收入

评论

回复: [评论]在温养房耗每月9成收入 房贷经纪∶房价不会大跌税前收入的91%,AFTER TAX? MORE THAN 100%, WHERE IS MONEY FROM?

评论

回复: [评论]在温养房耗每月9成收入 房贷经纪∶房价不会大跌看看这个Does it take 91% of household income to buy a detached bungalow in Vancouver?Posted on August 28th, 2012It’s significant news. Headlines and news stories are reporting that it takes a whopping 91% of household income to buy a bungalow in Vancouver.This number is based on research done by the Royal Bank of Canada (RBC) for its Housing Trends and Affordability Report released on August 27, 2012.Is this true? To find out we asked Cameron Muir, Chief Economist, at the BC Real Estate Association.Yes it’s true if we use RBC’s measuresMuir told us that if we use and accept the way these measures are constructed and what they are based on, then it does indeed take 91% of household income to buy a bungalow in Vancouver.Muir explains that RBC’s formula calculates the proportion of pre-tax income necessary to service the average priced bungalow in Vancouver, given a 25% down payment, a five year term at the current posted rate and a 25-year amortization.No, it’s not trueMuir explains that it would be impossible to obtain a mortgage loan that would require 91% of household income to service.“Lenders typically have a 32% gross debt service maximum” explains Muir.What’s the real story?Homebuyers at a medium income level who want to buy a detached bungalow in Vancouver are likely out of luck since it would take 91% of their income. “But don’t dwell on the 91%,” says Muir.Instead, Muir points to real estate industry data. “About 60% of home sales are now multi-family and almost 80% of new home construction is multi-family,” says Muir.Muir explains that first-time buyers are more likely to buy an condominium which would now require 45% of the median household income according to the RBC report.“With even more of a downpayment, this amount could potentially be carried by first-time buyers with a median household income,” says Muir.Although affordability is a significant problem in Vancouver, there are still many condominiums within the larger Metro Vancouver area in places such as Richmond and Coquitlam where prices are in line with what a household with a median income could afford.While it’s true that a detached bungalow on Vancouver’s Westside is no longer within the budget of a first-time home buyer, there are condominiums for sale in outlying areas that meet the affordability criteria.That’s the real story.

评论

回复: [评论]在温养房耗每月9成收入 房贷经纪∶房价不会大跌看看这个Does it take 91% of household income to buy a detached bungalow in Vancouver? Posted on August 28th, 2012 It’s significant news. Headlines and news stories are reporting that it takes a whopping 91% of household income to buy a bungalow in Vancouver. This number is based on research done by the Royal Bank of Canada (RBC) for its Housing Trends and Affordability Report released on August 27, 2012. Is this true? To find out we asked Cameron Muir, Chief Economist, at the BC Real Estate Association. Yes it’s true if we use RBC’s measures Muir told us that if we use and accept the way these measures are constructed and what they are based on, then it does indeed take 91% of household income to buy a bungalow in Vancouver. Muir explains that RBC’s formula calculates the proportion of pre-tax income necessary to service the average priced bungalow in Vancouver, given a 25% down payment, a five year term at the current posted rate and a 25-year amortization. No, it’s not true Muir explains that it would be impossible to obtain a mortgage loan that would require 91% of household income to service. “Lenders typically have a 32% gross debt service maximum” explains Muir. What’s the real story? Homebuyers at a medium income level who want to buy a detached bungalow in Vancouver are likely out of luck since it would take 91% of their income. “But don’t dwell on the 91%,” says Muir. Instead, Muir points to real estate industry data. “About 60% of home sales are now multi-family and almost 80% of new home construction is multi-family,” says Muir. Muir explains that first-time buyers are more likely to buy an condominium which would now require 45% of the median household income according to the RBC report. “With even more of a downpayment, this amount could potentially be carried by first-time buyers with a median household income,” says Muir. Although affordability is a significant problem in Vancouver, there are still many condominiums within the larger Metro Vancouver area in places such as Richmond and Coquitlam where prices are in line with what a household with a median income could afford. While it’s true that a detached bungalow on Vancouver’s Westside is no longer within the budget of a first-time home buyer, there are condominiums for sale in outlying areas that meet the affordability criteria. That’s the real story.点击展开... Cameron Muir, Chief Economist, at the BC Real Estate Association.

评论

回复: [评论]在温养房耗每月9成收入 房贷经纪∶房价不会大跌房产经纪告诉你: 房地产永远是上涨的,买房永远比租房合算,房贷经纪告诉你:市场放缓是暂时的,你永远拿不到现在这么优惠的房贷利率,要买房一定要赶早赶早。 首席经济学家告诉你:没有比现在更好的买房时机了。。 等把你的钱从口袋里掏出来,一切都有可能,但到时谁都不保证的。 我发现这种Chief Economist连头狗都不如。

·加拿大新闻 警方抓俩司机:407高速上飚时速233公里,401上飚189公里

·加拿大新闻 越来越多加拿大人选择"出国退休",2026年最佳目的

·加拿大新闻 安省公务员全面回归五天到岗,福特仍在给他们找办公室

·加拿大新闻 这些曾经20万+的合资B级车,现在15万内开走

·加拿大新闻 2025年一汽丰田新车销售805518辆,连续三年正增长

·中文新闻 莉-安妮·平诺克 (Leigh-Anne Pinnock) 透露,丈夫安德烈·格雷 (Andr

·中文新闻 自从 34 岁女儿意外去世以来,汤米·李·琼斯 (Tommy Lee Jones) 首次