在加拿大

今天是2021年度的RRSP供款最后一天了,明天供款属于2022年度了。

有个疑问,去年因为买房(非首套)从RRSP股票账户取出一部分钱,记得股票账户取出的钱自动被扣除30%金额的。现在问题是,2021年度报税是否把这部分从RRSP股票账户取出的钱计算为2021年收入?如果计算,是计算取出的全额还是扣除30%的金额?

评论

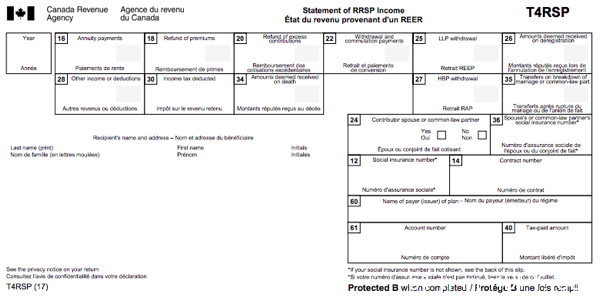

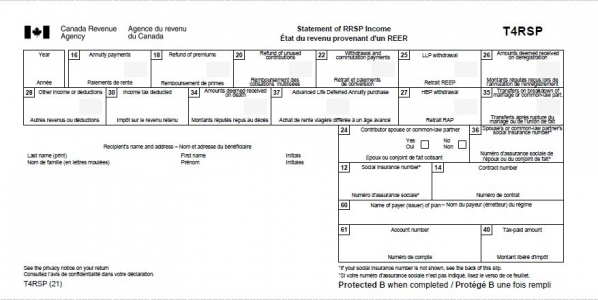

觉人之伪,不形之于色;吃人之亏,不动之于口;施人之恩,不发之于言;受人之惠,不忘之于心。 No need to do calculation yourself, you should have receipt mailed to you...

评论

Qtrade没 mailed to me...

评论

觉人之伪,不形之于色;吃人之亏,不动之于口;施人之恩,不发之于言;受人之惠,不忘之于心。 或许Qtrade会上传到CRA,你报税时自动导入报税软件

评论

是计算取出的全额。被扣除30%金额是预付税(Withhold Tax),你在今年报2021年度的税时,这30%预付税是可以抵消你今年应付的税。

评论

Life is simple, but not easy. Qtrade 网上没有 Statement of RRSP income (T4RSP)?你查看你的帐号里有关 Tax Return Slip.

BMO InvestorLine 在个人的帐号里有 T5, T3 等等。

评论

Life is simple, but not easy. 借此帖也问一个RRSP问题, 不小心一下子买多了, 怎么办?

因为是今年买的, 我感觉实际上可以变成一部分是今年的额度, 超额的哪一部分是明年的额度,

报税的时候只报今年的额度, 超的部分明年再报便可, 觉得应该可行...

评论

周导,应该明天是最后一天吧。

评论

觉得这不应该是阿吾犯的错误,如果买RRSP之前查一下CRA账户去年的报税资料,2021年度可以购买的额度就一目了然了

评论

很久没有用CRA账号了, 前几天登录的时候才知账号被取消了. 估计跟去年的CRA泄露有关.

暂时懒得注册, 就简单的按照收入的18%算了一下, 买满了额度, 后来才想起因为有公司的别的福利, RRSP额度不能这么算

评论

不超过2000元不用交罚款。

How to deal with RRSP over-contribution

There is no magic to resolve an RRSP over-contribution, you have to correct the situation and follow up with Canada Revenue Agency. The consequence, as mentioned above, is a 1% tax penalty on the over-contributed amount as well as a late-filing penalty if not corrected in the first 90 days of the calendar year – think the last day of March.There are 3 steps to follow to correct your situation but if you realize that you over-contributed before the calendar year is over, what you have to do is withdraw the amount you over-contributed as soon as you can.

You will have to fill out a form with your financial institutions to withdraw from your RRSP and you will be charged a withholding tax upon the withdrawal. Box 30 in the T4RSP form would have the tax paid on withdrawal when all is said and done for your tax return.To avoid the withholding tax, you will have to fill out the T3012A CRA form and provide details of your over-contribution situation. The financial institution will need the form to return the complete amount without any amount withheld. Box 20 in the T4RP form would have the amount to file your taxes.

Once you have step 1 & 2 completed, take a moment to call the Canada Revenue Agency to review your documents and the final steps. Check in with them to ensure all is in order. Make note of the person you are talking to and document your conversation with the CRA.

RRSP Over-Contribution Guide - 3 Steps To Fix Your Situation

Oh! Oh! You just found out you have, or may have, over-contributed to your RRSP and you want to know what to do next. I empathize with you as I also over-contributed to my RRSP once.评论

Life is simple, but not easy. 比如说,我取了5万(实拿到3. 5万),那么这5万算进2021年的收入了?

评论

觉人之伪,不形之于色;吃人之亏,不动之于口;施人之恩,不发之于言;受人之惠,不忘之于心。 那是我搞错deadline了?

评论

觉人之伪,不形之于色;吃人之亏,不动之于口;施人之恩,不发之于言;受人之惠,不忘之于心。 我的理解应该是。如果你收到T4RSP slip 时,在box16 里应该是5万,然后在box 30 里是3.5万。

评论

Life is simple, but not easy. 谢谢,顺便问一下在wealthsimple 怎么找RRSP供款金额?

·加拿大新闻 从追面子到享自我,宝马购车观转变

·加拿大新闻 看到快买加国Costco新晋爆款刷屏

·加拿大新闻 移民急刹车见效!加拿大人口首次出现历史性大幅下降

·加拿大新闻 每周连轴转80小时加拿大医生自爆行业黑幕

·加拿大新闻 万锦、Newmarket多家奶茶店/美甲店/理发店被指控+开罚单

·中文新闻 “这是掩盖”:科斯蒂·麦科尔的前夫在纽约歌手死亡童话故事

·中文新闻 米歇尔·基根 (Michelle Keegan) 和马克·赖特 (Mark Wright) 是溺爱小女