加拿大外贸

K Line dismisses bankruptcy speculationRepresentatives at Japanese shipping major Kawasaki Kisen Kaisha (K Line) have rubbished reports from China that the line will shortly follow Hanjin Shipping into administration.

A report carried by Shanghai Metals suggested K Line will file for bankruptcy protection within the next two weeks.

Kiyoshi Tokonami, general manager of K Line’s IR & PR Group, dismissed the report today. Speaking from K Line’s HQ, Tokonami told Splash rumours of them filing bankruptcy are “untrue, completely groundless”.

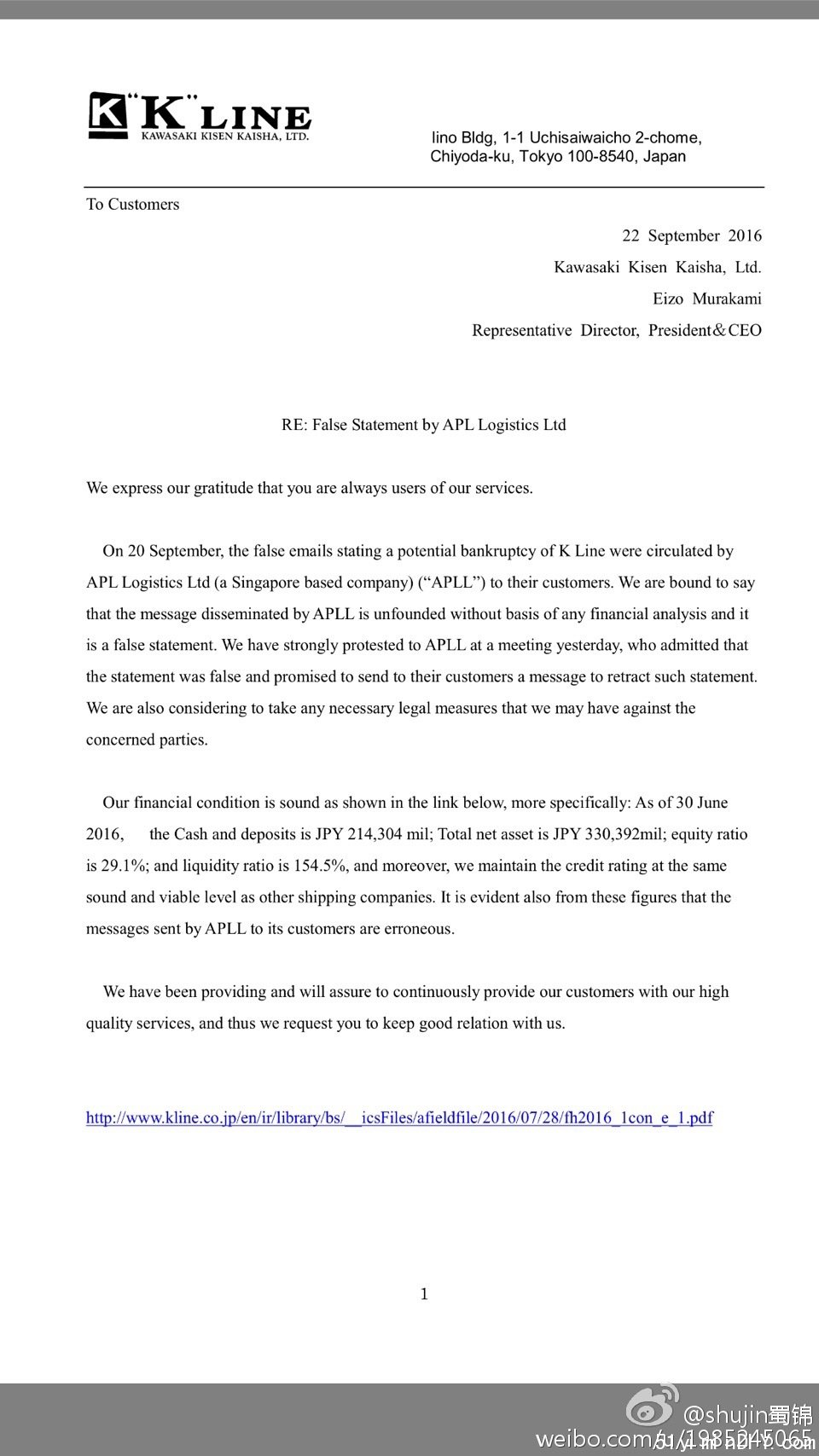

Adding further fuel to the bankruptcy speculation, Splash has received an image (pictured below) purportedly to be an emergency notice from a Chinese shipper that states K Line will follow Hanjin into court receivership either next week or within two weeks.

In May, ratings agency Moody’s downgraded K Line from Ba2 to Ba3. As of the end of its last financial year, March 31 2016, its gearing ratio stood at 1.48:1.

K Line, also in the red in the first quarter, warned at the end of July its full year loss will be worse than originally forecast. K Line is now bracing for a full year loss of Y45.5bn, some Y10.5bn worse than originally predicted in April, the start of the Japanese financial year.

Japanese shipping has been rocked by big bankruptcies in recent years – Sanko Steamship and Daiichi Chuo being the two most high profile. A K Line receivership, however, would be on a whole different scale given its scale and diverse business activities.

Earlier this month Splash reported that a Japanese fund run out of Singapore called Effissimo was gearing up to take over K Line.

Effissimo has been steadily building its stake in Japan’s third largest line to the point whereby it is now the largest shareholder with a 37% holding as of early August, up from 6.2% a year earlier.

Effissimo Capital Management, established in Singapore by ex-colleagues of activist investor Yoshiaki Murakami, has become the top shareholder in the line as well as in other well known Japanese brands such as office equipment maker Ricoh. Its strategy has been to target Japanese firms it deems undervalued.

However, K Line’s Tokonami today dismissed the takeover talk. “We are having dialogue, explaining our business plans as is usual with any shareholder,” Tokonami said, adding: “Effisimo says their stake is purely for investment purposes.”

K Line shares are trading today at JPY263, up by 2.7%.

原文链接 http://splash247.com/k-line-dismisses-bankruptcy-speculation/

随后访问了kline官网

http://www.kline.co.jp/en/

在官网新闻里我们看到最新的新闻是9-12日,并没有上述内容,按情理说,这样的市场谣言,影响比较大,为什么官网不发正式公告澄清?我们希望谣言不是真的,让外贸航运市场有点喘息机会。

评论

微博里看到

文章里提及的链接是上半年的财务数据 http://www.kline.co.jp/en/ir/lib ... fh2016_1con_e_1.pdf

评论

VIP 杠杠滴

评论

三人成虎,一切以官方为准

评论

反正要么KLINE 来一波低价挽回客户,要么就真的有可能性。

毕竟公关手段稳定股价是很正常的行为。

评论

K-LINE not KLINE

评论

一个是K-line 是一个是kline。

评论

关于K-LINE和 KLINE已经没有争辩意义,

还是看下接下来冀州KLINE的措施吧。

客户流失肯定不少,如果没有任何行动来挽回客户,就说明有问题

加拿大电商露天电影首发——葡中双语字幕《中央车站》 http://bbs.shanghai.com/thread-1714999-1-1.html screen.width*0.7) {this.resized=true; this.width=screen.width*0.7; this.alt='Click here to open new window\nCTRL+Mouse wheel to zoo 加拿大电商做区块链为什么都注册新加坡基金会 目前做区块链项目的客户都会通过注册基金会来作为项目的主体,为什么都在新加坡注册基金会,首先性价比高,而且新加坡市场也比较成熟,项目

·生活百科 疯狂地决定太阳能!

·生活百科 有热水系统的燃烧室吗?