加拿大外贸

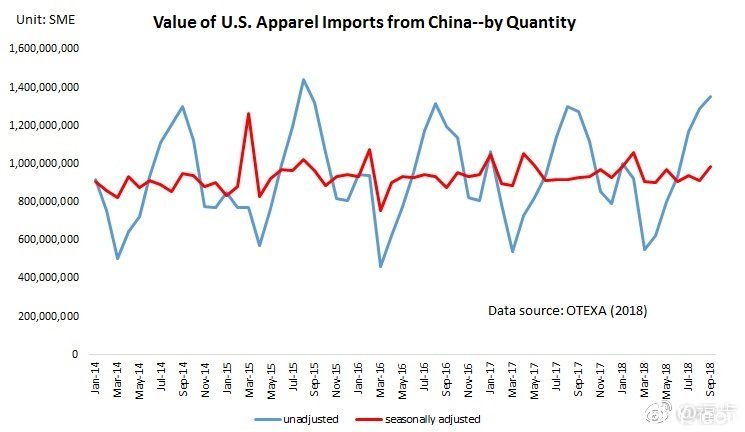

虽然服装产品尚未受到301条款的限制,但贸易行为仍然为美国时尚品牌和服装零售商带来了巨大的市场不确定性。以下是美国服装进口月度贸易流量如何反映美中关税战的影响:首先,美国公司并没有停止从中国进口。经季节性调整的数据显示,2018年1月至9月期间,从中国进口的美国服装价值同比下降0.6%,同比下降0.05%。尽管有所下降,但中国在2018年前9个月仍然是美国市场的第一服装供应商,占市场份额的32.3%和数量的41.3%,仅略微下降1和0.7个百分点。一年前分别。

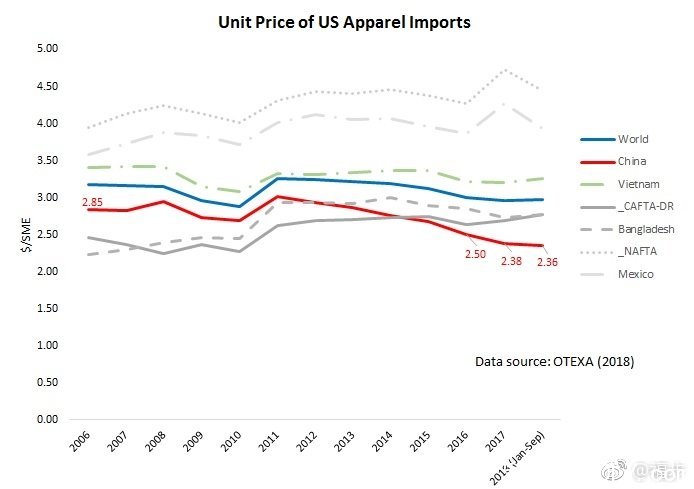

其次,服装“中国制造”变得更加便宜。值得注意的是,从中国进口的美国服装的平均单价从2016年的2.5美元/中小企业,2017年的2.38美元/中小企业降至2018年前九个月的2.36美元/中小企业。一方面,这一结果表明成本问题并非如此推动美国公司减少从中国采购的最有影响力的因素。然而,中国出口商也有可能故意降低价格以维持订单并克服301条款带来的挑战。

第三,“中国制造”没有完美的替代品。为应对301条款贸易行动所带来的市场不确定性,美国服装进口商正在使其采购基础多样化。话虽如此,很难确定一个最大的受益者 - 特别是,与一年前相比,越南,孟加拉国,北美自由贸易区和CAFTA地区的服装出口市场份额在2018年的前九个月仅略有增加。

此外,尚不清楚301条款的贸易行动是否有利于美国纺织品和服装制造业。数据显示,在2018年的前十个月,美国纺织品制造业的生产指数(2012年= 100)从2017年的92.8略微上升至94.3。然而,在同一时期,服装制造业指数从73.6下降至72.4。

展望未来,美国纺织品和服装从中国进口的数量可能会在短期内增加,因为美国进口商急于在新关税出现之前完成采购订单。通常情况下,公司会在销售旺季前几个月发出采购订单。然而,看看2019年上半年的贸易数据是否会显示301条款对中国服装出口到美国市场的负面影响将会很有意思。

==============

以上中文翻译自google, 你可以直接看原文

While apparel products are not subject to the Section 301 tariff yet, the trade action nevertheless has created huge market uncertainties for U.S. fashion brands and apparel retailers. Here is how the monthly trade flow of U.S. apparel imports has reflected the impacts of the U.S.-China tariff war:

First, U.S. companies did NOT stop importing from China. Seasonally adjusted data shows that between January and September 2018, the value of U.S. apparel imports from China decreased by 0.6 percent in volume and 0.05 percent in value year on year. Despite the decline, China remained the No.1 apparel supplier for the U.S. market in the first nine months of 2018, accounting for 32.3 percent market share in value and 41.3 percent shares in quantity, only marginally dropped by 1 and 0.7 percentage points from a year earlier respectively .

Second, apparel “Made in China” are becoming even cheaper. Notably, the average unit price of U.S. apparel imports from China dropped from $2.5/SME in 2016,$2.38/SME in 2017 to $2.36/SME in the first nine months of 2018. On the one hand, this result suggests that cost concern is not the most influential factor that drives U.S. companies to source less from China. However, it is also likely that Chinese exporters are intentionally reducing their price to keep their orders and overcome the challenges caused by the Section 301.

Third, there is no perfect replacement for “Made in China”. In response to the market uncertainty created by the Section 301 trade action, U.S. apparel importers are diversifying their sourcing base. That being said, it is difficult to identify a single largest beneficiary–notably, the market shares of apparel exports from Vietnam, Bangladesh, NAFTA, and CAFTA regions only marginally increased in the first nine months of 2018 compared with a year ago.

Additionally, it remains unclear whether the section 301 trade action has benefited U.S. textile and apparel manufacturing. Data shows that in the first ten months of 2018, the production index (2012=100) of textile manufacturing in the United States slightly increased from 92.8 in 2017to 94.3. However, over the same period, the index of apparel manufacturing decreased from 73.6 to 72.4.

Looking ahead, the volume of US textile and apparel imports from China is likely to increase in the short run since U.S. importers are eager to complete their sourcing orders before the new tariff hit. Usually, companies place sourcing orders several months ahead of the selling season. However, it will be interesting to see if the trade data in the first half of 2019 will reveal the negative impact of the Section 301 action on China’s apparel exports to the U.S. market.

文字来自美国的华人研究员sheng lu

https://shenglufashion.com/2018/ ... ated-november-2018/

评论

有一个老外Bernd的观点:

Some short remarks:

1. It is not correct to combine China with being cheap only. China is one of the few countries which is able to deliver high-quality goods in a quick and reliable way. Manufacturers there have invested a lot in equipment and people – and China has its own raw materials.

2. It is a myth that apparel brands can switch their suppliers like we change our underwear. From a certain quality level on it takes a while until a producer understands the needs of the buyer in terms of fashion, quality, social responsibility, standards, administration …. Finding professional suppliers is already difficult – changing them is far more difficult.

评论

另一个老外elaivina的观点

I feel like the import from China or in another word “Made in China” will decrease in the long run in the future. Not only because the tariffs are increasing, but also the nature of how China would like to contribute to the world is changing, from Chinese perspective. Products with lower value could be produced in countries with lower labor cast or wherever is cheaper than Made in China. And I believe that China doesn’t care about those lost orders. At the main time, China is improving its technology and other skills, which leads China to a higher level and looking for to become a developed country in the future. China might just focus on a significant part which China has the absolute advantage over it and labor intensive is no longer the absolute advantage for China I believe. We will find out.

评论

一个买手说了她今年年中的一个采购经历;

Over the summer, I was an Assistant Buyer intern for Ross in our Home department. Towards the end of the internship is when news of the first round of tariffs had just broken out, and it created a huge frenzy in the office, especially because a lot of my department, Garden, was affected immediately. However, we source through third parties like Li & Fung, and I was able to sit in on a few conference calls with them to talk about our options. Ultimately, the factories we were working with did not want to lose our business, so they lowered their prices to compensate for the tariffs. I believe that even though people think America depends too much on China, China also depends on America, and they are going to continue to push through these tariffs in order to keep large orders to American companies. I believe that, for the foreseeable future at least, America will continue to manufacture in China.

整个夏天,我在家庭部门担任罗斯的助理采购员实习生。 实习即将结束时,第一轮关税的消息刚刚爆发,它在办公室引起了巨大的狂热,特别是因为很多我的部门,花园,立即受到影响。 然而,我们通过Li&Fung等第三方采购,我能够与他们一起参加几个电话会议,讨论我们的选择。 最终,我们合作的工厂不想失去我们的业务,所以他们降低了价格以补偿关税。 我相信即使人们认为美国过分依赖中国,中国也依赖美国,他们将继续推行这些关税,以便向美国公司下大订单。 我相信,至少在可预见的未来,美国将继续在中国制造。

评论

另一个实习生分享她看到的

The apparel trade flow has started to find new apparel sourcing destinations, access trade flows, and learned to manage tariffs. It is extremely interesting to see how these tariff hits are currently effecting apparel sourcing because I was able to see first hand how it effects a brand. After interning at a company called Rebecca Minkoff as a public relations intern this past summer, I was able to see first hand how the sourcing, design, and financial sectors were affected by the first round of tariff hits. As it was mentioned in the reading above, sourcing managers at the company began scrambling to finish their orders ahead of time before any new tariffs hit. Our guest speaker on Monday emphasized something very important to any sector in the fashion industry. Every decision department made by individual sections of a company, will directly or indirectly effect another. For example, if a sourcing team changes where they import their apparel from, it will effect the designers and merchandisers because of pricing, textiles, and raw material and trading costs. As for China, with their prices continuing to drop, it will be hard for US to stop importing from them. These low costs will keep brands who are price conscious coming back, time and time again.

服装贸易流量已开始寻找新的服装采购目的地,获取贸易流量,并学会管理关税。看看这些关税点击目前如何影响服装采购非常有趣,因为我能够亲眼看到它如何影响品牌。在去年夏天在一家名为Rebecca Minkoff的公司实习公关实习后,我能够亲眼看到第一轮关税点击对采购,设计和金融部门的影响。正如上面的阅读中提到的那样,公司的采购经理开始争先恐后地提前完成订单,然后才会出现新的关税。我们的演讲嘉宾周一强调了对时尚界任何领域都非常重要的事情。由公司的各个部门制定的每个决策部门将直接或间接地影响另一个部门。例如,如果采购团队改变他们从哪里进口服装,则由于定价,纺织品,原材料和交易成本,它将影响设计师和商家。至于中国,随着价格持续下跌,美国很难停止从中进口。这些低成本将使价格意识的品牌一次又一次地回归。

=====================================

翻译都是google的 建议看英文原文

评论

最后一个老外的观点,我觉得是我个人也比较认同的。

I think China’s price reaction to the section 301 tariff is very interesting but not surprising. It seems a natural reaction for China to reduce their prices in order to persuade US firms to continue producing there as the US is its number one source of business. I also believe however hat this is a short term fluctuation as Chinese firms will not be able to offer such low prices and also accommodate Chinese wage requirements. I also believe that overtime the US will not be China’s number one source of business (specifically looking at the textile and apparel industry) regardless of President Trump’s tariffs. China is becoming and increasingly advanced country and as such will move into more capital intensive industries and more firms will move as many have been to cheaper labor, I do not believe that China will hold their competitive advantage of cheap labor for very much longer.

我认为中国对301条款关税的价格反应非常有趣但不足为奇。 中国降低价格似乎是一种自然反应,以说服美国公司继续在那里生产,因为美国是其最大的商业来源。 不过,我也相信这是短期的波动,因为中国公司无法提供如此低的价格,也无法满足中国的工资要求。 我还认为,无论特朗普总统的关税如何,加班美国都不会成为中国的头号商业来源(特别是纺织和服装行业)。 中国正在成为越来越先进的国家,因此将进入更多的资本密集型行业,更多的公司将会转向更便宜的劳动力,我不相信中国将在更长的时间内保持廉价劳动力的竞争优势。

评论

本身 这边接触的越南厂商跟台湾厂商也比较多

而大体情况是 原材料都拉到那边去做成品了

鞋材 纺织 占大宗 这个可以看深圳海关出口的大体数据 布料 鞋材 辅料等

简单点来看 你看看现在阿迪 耐克的标签就知道了 多少是来自越南产的吧

评论

只看本文好像觉得很轻松,其实不然,作者完成得2017年美国时尚服装协会的sourcing趋势和概貌一文里,讲述了更多有关美国采购的多样性sourcing, 里面的一些数字会让你大吃一惊,看看他们需要从多少国家询价就知道订单来得实在不容易了。点读 http://link.shanghai.com/down ... king-Study-2017.pdf ,可以看到31页的pdf, 建议服装从业人士一定要看看。

评论

其实服装行业并不是单单的取决于人力或土地成本,国内拥有完整的面料体系,上海宁波广州深圳等港口的吞吐能力,以及国内的运输能力,这些由基建带给我们的成本优势是东南亚不能比的

另一方面,国内也是在慢慢把制造业由沿海向内陆转移而已,内陆的劳动力成本,并没有比东南亚贵很多

实际每个订单算下来还是国内便宜

所以中美贸易摩擦对于中国服装出口美国,从实际情况以及数据上来看,影响并不大

评论

确实,现在很多品牌特别是那些折扣的的产地都是越南,泰国,印度等等

加拿大电商露天电影首发——葡中双语字幕《中央车站》 http://bbs.shanghai.com/thread-1714999-1-1.html screen.width*0.7) {this.resized=true; this.width=screen.width*0.7; this.alt='Click here to open new window\nCTRL+Mouse wheel to zoo 加拿大电商做区块链为什么都注册新加坡基金会 目前做区块链项目的客户都会通过注册基金会来作为项目的主体,为什么都在新加坡注册基金会,首先性价比高,而且新加坡市场也比较成熟,项目

·加拿大新闻 看到快买加国Costco新晋爆款刷屏

·加拿大新闻 从追面子到享自我,宝马购车观转变

·加拿大新闻 每周连轴转80小时加拿大医生自爆行业黑幕

·加拿大新闻 万锦、Newmarket多家奶茶店/美甲店/理发店被指控+开罚单

·加拿大新闻 移民急刹车见效!加拿大人口首次出现历史性大幅下降

·中文新闻 一名男子因推动反犹太复国主义而在悉尼市议会市长的长篇大论

·园艺 蒜黄和蒜芽