在加拿大

请问各位landlord们,在和律师缴费的时候,有没有见到letter of direction这一项的收费。这个是个什么意思?第一次买房,很多事情不懂,由经纪介绍的一个老外律师。到了closing date的前一天了,律师让我交给他银行开的bank draft,他通过电话告诉了我要交的费用总额,包括downpayment,和一些其他费用。我也没有细问,毕竟俺英语也不好,在电话里更是说不清楚。等到了他的办公室签字并把check交给他的时候,发现付钱的清单里有一项是 paid letter of direction,价格是1380 刀,其他几项是 paid to register deed, 71.30; paid to register mortgage, 71.30; paid title insurance 168.60; paid legal fees and disbursements 1626.14, 总共几项加起来是 3317.34 刀。第一次买房,实在不知道这几项是什么意思。特别是那个letter of direction,在网上也查不到是什么。请大家给指教。另外,这个letter of direction费用能不能取消不要。这个律师费太贵了,上当了不知道怎么办。老外太坏了。因为俺们这边近的地方没有中国人律师,所以本找了老外。现在后悔啊。

评论

我帮你google了下,这个letter of direction好像是那种买旧房卖新房之间有时间差需要银行或财务机构提供借款衔接用的,我自己买房子的律师费没有这项费用,title insurance比你的还贵。

评论

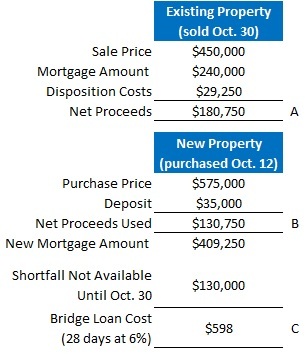

原文在这里,靠后红字部分提及letter of direction,你自己看看分析是不是一样的东西。Bridge Financing – A Solution When Buy and Sell Dates Don’t Overlapby Dave LarockIf you want to sell your current home and use the proceeds as a down payment

on a different property, what do you do if the closing dates don’t fall on the same day? More to the point, what do you do if you have to buy your new home before you sell the old one? In these cases you need a short-term loan to bridge the gap between the two transaction dates and the solution, appropriately enough, is called bridge financing. Today’s post will explain how it works for borrowers who are considering this option.Let’s start by addressing a few common concerns: If you need a bridge loan, it does not alter or limit your ability to qualify for a mortgage in any way. Also, you don’t actually need to qualify for bridge financing itself – the only requirement is that you have an unconditional offer to purchase for the property you are selling. It is almost always offered in combination with a traditional mortgage loan – your lender simply bridges your financing gap to help facilitate the overall transaction.Here is an example of how a bridge loan would work:

on a different property, what do you do if the closing dates don’t fall on the same day? More to the point, what do you do if you have to buy your new home before you sell the old one? In these cases you need a short-term loan to bridge the gap between the two transaction dates and the solution, appropriately enough, is called bridge financing. Today’s post will explain how it works for borrowers who are considering this option.Let’s start by addressing a few common concerns: If you need a bridge loan, it does not alter or limit your ability to qualify for a mortgage in any way. Also, you don’t actually need to qualify for bridge financing itself – the only requirement is that you have an unconditional offer to purchase for the property you are selling. It is almost always offered in combination with a traditional mortgage loan – your lender simply bridges your financing gap to help facilitate the overall transaction.Here is an example of how a bridge loan would work: Assume you have just accepted an unconditional offer to purchase your current property on October 30. After paying off your mortgage and covering your disposition costs, you will be left with net proceeds of $180,750 (see item A).You then buy a new property, but the sellers want you to take possession on October 12, which is 18 days before you will complete the sale of your existing home. After making a $35,000 deposit, you decide to use $130,750 (see item B) of the net proceeds from the sale (you hold back $50,000 for closing costs and minor renovations).You need that $130,750 on October 12, but you won’t receive it from your buyer until October 30. As such, your mortgage planner helps you secure an 18-day bridge loan at prime +3% (6% in today’s terms) at a total cost of $385 (see item C). Problem solved.Lenders typically expect a gap of no more than 30 days between your buy and sell dates, although bridges for longer periods may be offered by some lenders on an exception basis. Because bridge loans are usually unsecured and short term, lenders charge higher rates; as in the example above, you should expect to pay somewhere in the range of prime + 3% to prime + 4%, which works out to 6% to 7% in today’s terms (some lenders will also charge an application fee of approximately $250). Keep in mind that, on balance, bridge loan rates will have far less impact on your overall financing costs than mortgage rates because they only apply on the shortfall, and they are only in place for a brief period of time.If you have borrowing room on any existing lines of credit, most lenders will ask you to draw down these lines first, before then bridging the remaining gap. On the day you complete the purchase of your new home, you will be required to sign a Letter of Direction and Irrevocable Assignment of Funds. This is a promise to use your net sale proceeds to pay off the lender’s bridge loan before taking any money for yourself. On larger bridge loans your lender may go a step further and require that a collateral charge be registered on the property you are selling (this is a slightly more expensive step that achieves the same basic end).

Assume you have just accepted an unconditional offer to purchase your current property on October 30. After paying off your mortgage and covering your disposition costs, you will be left with net proceeds of $180,750 (see item A).You then buy a new property, but the sellers want you to take possession on October 12, which is 18 days before you will complete the sale of your existing home. After making a $35,000 deposit, you decide to use $130,750 (see item B) of the net proceeds from the sale (you hold back $50,000 for closing costs and minor renovations).You need that $130,750 on October 12, but you won’t receive it from your buyer until October 30. As such, your mortgage planner helps you secure an 18-day bridge loan at prime +3% (6% in today’s terms) at a total cost of $385 (see item C). Problem solved.Lenders typically expect a gap of no more than 30 days between your buy and sell dates, although bridges for longer periods may be offered by some lenders on an exception basis. Because bridge loans are usually unsecured and short term, lenders charge higher rates; as in the example above, you should expect to pay somewhere in the range of prime + 3% to prime + 4%, which works out to 6% to 7% in today’s terms (some lenders will also charge an application fee of approximately $250). Keep in mind that, on balance, bridge loan rates will have far less impact on your overall financing costs than mortgage rates because they only apply on the shortfall, and they are only in place for a brief period of time.If you have borrowing room on any existing lines of credit, most lenders will ask you to draw down these lines first, before then bridging the remaining gap. On the day you complete the purchase of your new home, you will be required to sign a Letter of Direction and Irrevocable Assignment of Funds. This is a promise to use your net sale proceeds to pay off the lender’s bridge loan before taking any money for yourself. On larger bridge loans your lender may go a step further and require that a collateral charge be registered on the property you are selling (this is a slightly more expensive step that achieves the same basic end). While not all lenders offer bridge financing, an experienced, independent mortgage planner will have access to several who do. So instead of worrying abo

While not all lenders offer bridge financing, an experienced, independent mortgage planner will have access to several who do. So instead of worrying abo评论

非常感谢楼上的回复。现在明白了一点。但是我根本就没有卖房然后在买房的事情,为啥律师还给我弄了这个呢?因为5月30日本来是closing date,但是因为我的贷款没有到账和对方的一点问题导致closing date推到1个星期后了,现在还有没有可能让律师把这个letter of direction 给取消,把钱还给我呢?

评论

再次感谢您的热情帮助。因为closing date往后推迟了,那律师是不是要重新计算费用呢?补给卖方地税啥的是不是也要变了。如果律师把应该付的项目算错了,能不能让他更改?我已经在5月29日到他办公室签了字,当时是一堆的文件,虽然他一个一个让签的,当时真的是稀里糊涂的。因为想着是经纪介绍的,经纪说她以前用过这个律师,所以就非常相信了。是不是所有文件要重新到律师处签字?我的经纪跟我说律师费不是很贵,实际上比多伦多的中国人的律师贵多了。还有,这个letter of direction,我问了她,她说从来都没有见过。我帮你google了下,这个letter of direction好像是那种买旧房卖新房之间有时间差需要银行或财务机构提供借款衔接用的,我自己买房子的律师费没有这项费用,title insurance比你的还贵。点击展开...

评论

我不是很懂这些东西,不过你可以打电话到该律师楼问问为什么会有这个费用,一千多呢。

·加拿大新闻 从追面子到享自我,宝马购车观转变

·加拿大新闻 看到快买加国Costco新晋爆款刷屏

·加拿大新闻 移民急刹车见效!加拿大人口首次出现历史性大幅下降

·加拿大新闻 每周连轴转80小时加拿大医生自爆行业黑幕

·加拿大新闻 万锦、Newmarket多家奶茶店/美甲店/理发店被指控+开罚单

·中文新闻 一名男子因推动反犹太复国主义而在悉尼市议会市长的长篇大论

·园艺 蒜黄和蒜芽